It’s Panama, Not Pandora!

Panama. Panama. Panama. What is all the fuss about Panama?

Warning: This report is quite lengthy. If you have a knack of reading (which I hope you do), read it all.

Let us start with the introductions. You can skip the introductions if you know them all, but I strongly advise you to go through them as there are a few interesting pieces of information that I have included for a better macro-perspective.

Who Is Who? – The Stakeholders

State of Panama

Before all this, Panama was just a small country-state with a population of 4 Million, occupying a key territory in Central America connecting North and South America. In December 1989, the United States attacked Panama to depose the ruling dictator Manuel Noriega (like we haven’t heard that before).

The United States even has a Free Trade Agreement with Panama which forces the Panamian authorities to disclose names of all US citizens with offshore holdings via the FATCA (Foreign Account Tax Compliance Act). Panama has recently been taken off the Financial Action Task Force (FATF) Gray List, and discriminatory tax list of Paraguay.

Americans have their own tax haven states such as Nevada, so it is not a surprise to not see many American influential names. However, it is important to note that the FATCA and Free Trade Agreement are recent events, and considering the data is spanned over the last 40 years, not being able to witness one powerful name still rings some bells about the overall authenticity of the publication.

The response of the State of Panama has been strong against allegations of its territory being used as an offshore tax haven for illegal purposes. The Procuraduria de la Nacion has announced an investigation concerning “Panama Papers” where a local firm Mossack Fonseca is involved. This follows the re-registration of Panama in the list of tax havens by France, and the Organization for Economic Cooperation and Development (OECD) Secretary General’s uni-directional attack at Panama, whereas a total of 21 other jurisdictions have also been named, with the British Virgin Islands at the forefront.

Another law firm, Morgan & Morgan accused the OECD of being behind the campaign to subvert the competition that Panama poses in terms of financial services, in the interest of other countries. Since this trove of information was uncovered through a ‘hack’ rather than an official investigation, it indeed reflects Panama in an unfair manner. Legislation which will follow in several countries around the globe will hurt the Panamian economy.

Mossack Fonseca

Mossack Fonseca is a Panamian law firm and corporate service provider, which facilitates the international business community in setting up offshore companies. It has been in operation since 1975, and has never been summoned to court for any wrongdoings in its 40 year history. It is owned by German lawyer Jurgen Mossack, and Panamian novelist/lawyer Ramon Fonseca. A Swiss lawyer Christoph Zollinger joined in as a third director.

Did you know?

During World War II, Jurgen Mossack’s father, Erhad Mossack was a Rottenfuhrer (senior corporal) in the Waffen-SS, which was the armed wing of the Schutzstaffel, a paramilitary organization established to ensure the racial policy of Nazi Germany.

Even after the leaks, the Panamian law firm claims that it is not involved in any wrongdoing, and all transactions made through it have been legal. If there are legal loopholes in the British and American system, then that is a completely separate debate. Moreover, it is interesting to note that more than 500 banks registered nearly half of the companies uncovered by the data, with HSBC and Swiss banks such as Credit Suisse, demanded over 3000 companies for their clients. An HSBC spokesperson said:

“The allegations are historical, in some cases dating back 20 years, predating our significant, well-publicized reforms implemented over the last few years.” True. You cannot be punished for a crime that was not a crime when it was committed. No retroactive punishment.

“Our industry is not particularly well understood by the public, and unfortunately this series of articles will only serve to deepen that confusion. The facts are these: while we may have been the victim of a data breach, nothing we’ve seen in this illegally obtained cache of documents suggests we’ve done anything illegal, and that’s very much in keeping with the global reputation we’ve built over the past 40 years of doing business the right way, right here in Panama. Obviously, no one likes to have their property stolen, and we intend to do whatever we can to ensure the guilty parties are brought to justice. But in the meantime, our plan is to continue to serve our clients, stand behind our people, and support the local communities in which we have the privilege to work all over the world, just as we’ve done for nearly four decades.”

– Mossack Fonseca

Mossack Fonseca insists that reporting of ICIJ “rely on supposition and stereotypes”, and “play on the public’s lack of familiarity with the work of firms like ours.”

In its official statement, Mossack Fonseca suggested that responsibility for potential legal violations may lie with failures or lapses by the other institutions they deal with such as international financial institutions, trust companies, prominent law and accounting firms, who act as intermediaries and are regulated in the jurisdiction of their own businesses.

Unencrypted emails, and systems older than your dog.

“There are many lessons to be learned from this week’s leak of the so-called “Panama Papers,” but here’s some real news you can use: If you’re a law firm dealing with the highly sensitive financial information of the world’s most powerful people, you should probably update your software more than once every seven years.”

– Fortune Magazine, 2016

John Doe – Hacker/Whistleblower

The hacker or whistleblower who stole/retrieved data from Mossack Fonseca’s servers and passed it on to a journalist belonging to a German media group Suddeutsche Zeitung (SZ), was a John Doe. John Doe implies that the person had requested anonymity, and so he is referred to as John Doe.

The co-founder Fonseca said that the leak was not an inside job, and that the company had been hacked by servers based abroad. Investigations will reveal where this hack was initiated from and action taken likewise.

What possibly made things easier for the hacker to retrieve information was the fact that the security software of the Law firm’s database was last updated in 2009. If a law firm were built for the purpose to hide people’s wealth, it would not make a careless mistake as such. Especially when you are dealing with Kings and Emirs and heads of states and their spouses.

International Consortium of Investigative Journalists (ICIJ)

This is a group of journalists brought together under the umbrella of the Centre of Public Integrity, headquartered in Washington DC, and funded by organizations such as the Ford Foundation, Rockafella Foundation and Open Society Foundations of George Soros, a multi-billionaire, first known for breaking the Bank of England by short selling the pound, and his suspicious activities and presence during other financial crises.

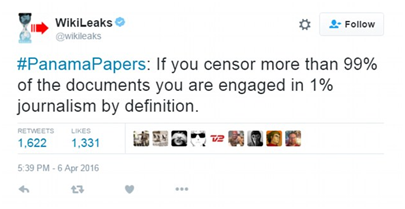

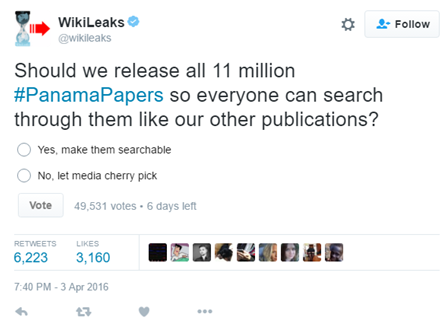

George Soros is also currently funding Hilary Clinton’s campaign against another multi-billionaire, Donald Trump. Some corners believe that Panama Leaks is also a George Soros conspiracy, meant to destabilize the region, or give Trump a setback by re-igniting hatred towards wealthy businessmen. Politically, Soros has nothing to lose, whereas Trump may. Moreover, WikiLeaks argued via a tweet that the connection between the ICIJ and the American government would undermine the integrity of the news leak.

Interestingly, The Center for Public Integrity is a 501(c)(3) tax exempt organization. Which basically means that it is registered in such a way to AVOID being taxed. Tax avoidance will be discussed in further detail later on in the report.

The British Virgin Islands

Why are the ‘British Virgin Islands’ called the ‘British Virgin Islands’? Is it a mere coincidence or does it come under the Queen’s rule? If so, then why is it the biggest hub for offshore companies? Why does the country’s economy run on financial services tendered? Again, is the British system so weak that it cannot detect money laundering and tax evasion under its own nose, in its own territory?

The British Virgin Islands, as suggested by the name, is a British colony where the Governor is appointed by the Queen on the advice of the British Government. In terms of tax laws, it is similar to Panama, Cayman Islands and Nevada. Most offshore companies are registered in the British Virgin Islands, as also revealed in the data leak.

What Is What? – Some Definitions

What Is An Offshore Company?

An “Offshore company” a.k.a International Business Company, is a company set up in a neutral state for international business transactions, especially when the two or more countries engaged in business are governed by different laws, rules and regulations, especially in terms of tax laws. Countries all over the world fight for capital inflow in the form of tourism, investments, development aid, and other means. As a result, nation states have developed legislation that favor the economy by attracting investment. Competition pushes countries to extremes and some like Panama, British Virgin Islands, the Cayman Islands and US states like Nevada, have (through legislation), established facilities for the international business community to conduct transactions between two states with differing tax laws. Thus they are known as ‘tax havens’.

Offshore companies are used for legitimate reasons. It may be used for illegitimate reasons as well. Just how a mobile phone can be used to make a friendly call, or set of a bomb. If a corrupt person uses Mobilink and has a bank account in Bank Alfalah, this does not imply that all people using Mobilink or a bank account with Bank Alfalah are corrupt. The same way, if some corrupt people are using offshore companies to hide their wealth, it does not imply that all people with offshore companies are using them to hide their wealth. If it were being used for that purpose, these offshore companies would not be located in American and British territories, who apparently have very strict tax evasion laws. Spy agencies make use of these accounts as well. But we will never see the name of Agent 007 in the ‘Power Players’ section, because the real ‘Power Players’ work from the shadows.

Moreover, good lawyers know that the lower the tax burden is, the higher the scrutiny. So tax havens in fact indulge in more scrutiny and strictly adhere to KYC (Know your Customer) policy which requires them to understand legitimacy of the contract they are about to come under.

Mossack Fonsecca denies any wrongdoing, and has published its reply to baseless allegations from around the world regarding its business model. The company claims to not have been summoned to court once in its 40 year existence. The company policy in fact states that politically effected persons (PEPs) are subject to heavier scrutiny than the commoner, having to declare the source of income as well as non-affiliation with politics.

“Politically Exposed Persons (PEPs): We have duly established policies and procedures to identify and handle cases where individuals either qualify as PEPs or are related to them. As per our Risk Based Approach, PEPs are considered to be high risk individuals. Hence, enhanced due diligence procedures apply in these cases. Also, periodic follow-up is conducted to assure that no negative results are found. Lastly, according to international KYC policies, PEPs do not have to be rejected just for being so; it is just a matter of proper risk analysis and administration to perform enhanced due diligence on them.”

– Mossack Fonseca

Tax Evasion vs Tax Avoidance

First of all, there is a huge difference between tax EVASION, and tax AVOIDANCE. Tax EVASION refers to ILLEGAL actions that deliberately misrepresent the true state of affairs to tax authorities to reduce tax liability and include dishonest tax reporting such as declaring less income, or gains from the amounts that are actually earned. On the other hand, tax AVOIDANCE is the LEGAL use of tax laws to reduce one’s burden from unnecessary taxation, or to avoid double taxation. Avoiding taxes is perfectly legal, whereas evading taxes is not.

“It’s not that they’re breaking the laws, it’s that the laws are so poorly designed that they allow people, if they’ve got enough lawyers and enough accountants, to wiggle out of responsibilities that ordinary citizens are having to abide by.” – US President Barack Obama’s views on Panama Leaks

The legal section of the ICIJ Panama Papers website states the following:

“There are legitimate uses for offshore companies, foundations and trusts. We do not intend to suggest of imply that any persons, companies or other entities included in the ICIJ Power Players interactive application have broken the law or otherwise acted improperly.” Yes. There are some typographical errors in their official statement.

“Our company does not advise clients on the structuring of corporate vehicles and the use they may make of them. We likewise do not offer solutions whose purpose is to hide unlawful acts such as tax evasion. Our clients request our services after being duly advised by qualified professionals in their places of business. Moreover, it should be made clear that tax avoidance and evasion are not the same thing. For example, a client can use the structures provided by us for tax optimization of his/her estate, such as taking advantage of provisions in treaties for avoiding international double taxation. Such behavior is perfectly legal.”

– Mossack Fonseca

Moreover, inheritance laws differ between states and even religions. Some offshore companies are used as trusts which are to carry out legal transactions in the light of an event. Pakistan’s inheritance laws differ widely from that of the UK’s, where a 40% tax rate applies to anyone owning assets over and above 400,000 British pounds. An offshore company can help avoid forced taxation, and allow religious systems and states to practice their inheritance system, which is a private matter of how private wealth is to be distributed amongst the family.

Similarly, if a person is paying tax in the country they reside for capital gains or income that they receive from offshore properties, they can avoid being double taxed. As long as they are abiding all tax laws and have declared all of their assets to the authorities where they reside in.

“Journalistic Ethics”?

To get facts straight, the “Panama Leaks”, as coined by the International Consortium of Investigative Journalists (ICIJ), is a leak of more than 11.5 million financial and legal records to the tune of 2.6 Terabytes of data. One fine morning, a journalist belonging to a German media group received a text message from John Doe asking him if he was “interested in data”. The Data belonged to a Panamian law firm, Mossack Fonseca, which offers legal services for businessmen interested in setting up companies including offshore companies around the globe. It includes pdfs, pictures (including passport photos), emails and other files that the law firm had kept in a systematic manner, in named folders.

Journalists at the German media group (SZ), having heard of the ICIJ, approached the consortium with the data. For one year, journalists at the ICIJ scanned the data for names of big players with international recognition, and attempted to connect some dots that they believe would paint a true image of how offshore tax havens are operated.

The raw data is nowhere to be found, and now our only source of information is the ICIJ, which claims to have all the data with them. As a scientist, I would like to see the raw data, in its original form. Just like how a court demands raw footage, audio recordings or witnesses that have not been altered or tortured. Not the data that these ‘journalists’ have been torturing for over a year. The leak would be more credible if it had been shared publicly the moment it was publicized by the whistleblower. Rather than having “investigative journalists” see the data, it should have been directed to the REAL investigative authorities who could have taken better, more precise and swift action to deal with any illegal activity that they may have suspected. Instead, the data was used by journalists and the media for whatever purpose they may find suitable, implicating whoever they opined to be behaving illegally, creating global instability at a time when the whole world is fighting the menace of terrorism, from Paris to Lahore to Brussels to Africa. Is this sensible journalism? Is this ethical journalism?

Even Icelandic investigative journalist and WikiLeaks spokesperson Kristinn Hrafnsson has called for the raw data to be published in full. WikiLeaks officially criticized ICIJ through a tweet stating:

And a pun, for those who understand:

In turn it was criticized that the decision to disclose all documents at once would not have been right in light of “journalistic ethics”.

Now let us examine the data in light of this knowledge:

The Data

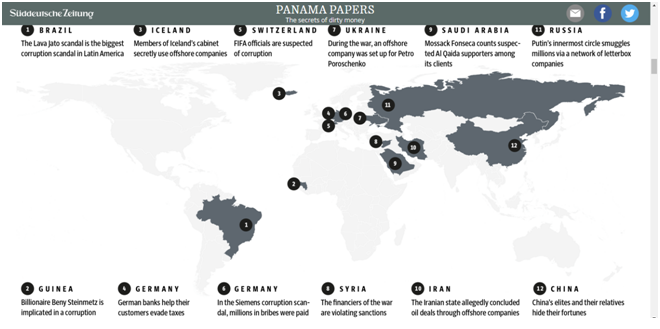

Question: Which countries’ power players have been implicated?

Answer: Algeria, Angola, Argentina, Azerbaijan, Belgium, Botswana, Brazil, Cambodia, Chile, China, Colombia, Congo, The democratic Congo, Republic of Cote d’Ivoire, Ecuador, Egypt, Finland, France, Georgia, Ghana, Greece, Guinea, Honduras, Hungary, Iceland, India, Iraq, Italy, Jordan, Kazakhstan, Kenya, Luxembourg, Malaysia, Malta, Mexico, Morocco, Nigeria, Pakistan, State of Palestine, Panama, Peru, Poland, Portugal, Qatar, Russian Federation, Rwanda, Saudi Arabia, Senegal, South Africa, Spain, Sudan, Switzerland, Syrian Arab Republic, Ukraine, United Arab Emirates, United Kingdom, Venezuela and Zambia.

While we do see some prominent western states, many of them such as Belgium, Finland, Luxembourg, and Switzerland are not implicated directly (i.e. power players do not belong to that state) and are only mentioned in relation to power players from other states. Interestingly, the ‘Power Players’ section does not list a single American, Australian, Canadian or Israeli. Only recently, an American firm had brought the whole global economy crashing in 2006, when accounting malpractices and corruption of such wide-scale was caught in US soil. Their own financial system allows for offshore companies to be established under the label of “LLCs”. That is what the state of Nevada is used for in the United States. And if there are not any names of Americans, I am not surprised. Not because the organization behind the leaks are based out of Washington. There are only a few possibilities. Either these states are honest to the core, or their power players are smart enough to use alibis, or information regarding their activities have been concealed. The last possibility would not have arisen if the data were shared immediately rather than after being tortured for a year. Who really knows what the real data looks like now? Mr. John Doe? Or could he be compromised too?

Only France and UK are two prominent western states that have been implicated in this mess. France was quick to re-register Panama as a tax-haven state, while UK felt the heat to introduce legislation. France and UK have not much to worry about, and will be able to wiggle through the hype given their strong systems and educated public. Even if their leaders resign and call for fresh elections, it will not have much impact on political stability ratings of the country. But that will not happen, as these mature democracies, (and not to forget nuclear-powered) know how to deal with media hype.

Let us look at reports published by ICIJ regarding power players of some countries to get an overall idea of how these offshore companies have been used.

What Happened In Georgia?

“Although he served barely 13 months as prime minister, billionaire Bidzina Ivanishvili left an indelible mark on Georgia history. After 20 years in Russia, where he made a fortune in the metals and banking industries, Ivanishvili returned to Georgia in 2003 and became known as a reclusive philanthropist and collector of fine art and exotic animals. In 2011, he turned his growing displeasure with the government into political activism. He ultimately led a coalition called the Georgian Dream to a stunning victory in the 2012 parliamentary election and took the job of prime minister. Ivanishvili resigned voluntarily after his party won the 2013 presidential election but continued to wield power behind the scenes. In March 2016, lawyers acting on behalf of Ivanishvili filed a complaint with Geneva prosecutors against Credit Suisse Group AG after Ivanishvili alleged he was victim of fraud by a former employee of Credit Suisse.”

Inside the Mossack Fonseca data – British Virgin Island authorities wanted information on the offshore company.

“Bidzina Ivanishvili was owner of Lynden Management Ltd., a company based in the British Virgin Islands. In 2011, the BVI Financial Investigation Agency asked Mossack Fonseca for information about the company’s ownership and activities. Mossack Fonseca’s Singapore office confirmed then that Ivanishvili was a beneficiary of a trust set up by Credit Suisse, and Lynden Management’s activity was to hold assets. Two years later, Mossack Fonseca BVI identified Ivanishvili as a Politically Exposed Person and asked its Singapore office for documents proving Ivanishvili’s identity and the source of funds for Lynden Management. Singapore was unable to obtain them and later asked if their client, Credit Suisse, could instead “carry out reduced due diligence” on Lynden Management as the bank was “a regulated trust company” and had “many companies with Mossack.”

Response

“A Swiss law firm representing Ivanishvili said that he is “willing to be transparent” about his use of offshore companies and that banks like Credit Suisse “systematically” propose offshore companies to their clients though it may not serve the client’s interest.”

In all this tussle, we forget about banks and investment institutions that guarantee good returns and value for money. Investment bankers look for all legal possibilities to maximize a client’s portfolio. It is their job to do so. And many a times, the investor has no idea what the banker is doing with his money. As long as he is performing, he is good to go. And as long as the law allows them to act this way, they will.

An Indian Judge in Kenya

“Kalpana Rawal, who became Kenya’s Deputy Chief Justice in June 2013, has been fighting an attempt by the Judicial Services Commission to force her to retire from Kenya’s Supreme Court on her 70th birthday in January 2016. She filed suit in September, arguing she was appointed under a previous constitution that let judges work until they turn 74. In December , a five-judge panel ruled against her, but she has appealed. She has noted that the issue is bigger than just her case and could effect the retirement and pension rights who were appointed under the previous constitution. Rawal, who moved from India to Kenya in 1973, assisted the International Criminal Court’s investigation of Kenya’s post-election violence in 2007-2008. She also led the probe of a 2012 helicopter crash that killed Kenya’s security minister.”

Inside the Mossack Fonseca data – Used offshore companies to buy and sell London real estate.

“Rawal and her husband were directors of two companies based in the British Virgin Islands, prior to her joining the nation’s Supreme Court. The family used other offshore companies to buy and sell real estate in London and nearby Surrey. Montague Real Estate SA was used in 2004 to buy a London flat for $1.12 million, which they sold in 2006. Innovate Global Limited was used to buy a house in Surrey for $2.74 million and a London apartment which they bought for $967,000 in 2004 and sold for $1.62 million in 2013. Through Arklyn International Limited, they bought another two London apartments, one bought for $1.66 million in 2005 and sold for $2.23 million in 2011, and the other bought for $1.57 million in 2005 and sold for $2.15 million in 2012.”

Response

“Rawal said she has not been involved with the family businesses except for generally knowing they were involved in real estate. She was listed as director on two of them without her knowledge by her husband when he was told two directors were required, she said. The first one never did any transactions and is dormant. The second one acquired a property. “My family members include my two adult sons residing in London, both of whom are British subjects and run the business as per the laws applicable in U.K.” She said has never had “any involvement direct or indirect and have no interest or control” in the other companies.”

Yes. There is yet another grammatical error in ICIJ’s report. Professionalism at its best.

Family business is family business. And one can choose not to be part of it. Except for acting as a trustee, which is an acceptable family practice.

Saudi Arabia

Inside the Mossack Fonseca data – British Virgin Island company used for mortgages on luxury homes in London and to hold yacht.

“King Salman held an unspecific role in Luxembourg company Safason Corporation SPF S.A., which was the shareholder of Verse Development Corporation, incorporated in the British Virgin Islands in 1999, and Inrow Corporation, incorporated in 2002. Inrow took out a mortgage in 2009 worth up to $26 million and Verse took out a second mortgage worth more than $8 million both of which were for luxury homes in central London. While King Salman’s precise role is not specified, both mortgages are mentioned “in relation to” him and his assets. King Salman was also described as “the principal user” of a motor yacht, Erga, named after the King’s palace in Riyadh, Saudi Arabia, and registered in London by the BVI company Crassus Limited, incorporated in 2004. The records of another BVI company, Park Property Limited, incorporated in 2005 and of which Safason Corporation was the sole shareholder, were kept at Erga Palace.”

UAE

Inside the Mossack Fonseca data – British Virgin Islands companies used to buy luxury real estate and other properties.

“Sheikh Khalifa was the beneficial owner of at least 30 companies established in the British Virgin Islands by Mossack Fonseca, through which he held commercial and residential properties in pricey areas of London such as Kensington and Mayfair, worth at least $1.7 billion. The Sheikh financed his acquisitions through loans from the London branch of the National Bank of Abu Dhabi and the Royal Bank of Scotland. Until 2007, Mossack Fonseca provided companies that acted as directors and shareholders of the Sheikh’s BVI companies. By December 2015, nearly all the shares in those companies were held by Mossack Fonseca through trust structures, but the true beneficiary remained the Sheikh, as well as his wife, son and daughter. In 2011 Mossack Fonseca wrote that the law firm handling Sheikh Al Nahyan’s affairs was “usually hesitant” in providing information about his identity.”

Do King Salman and Emir of UAE hide their wealth in offshore companies? Do they really need to? Do they want to? These transactions are not even peanuts of the real wealth of these people, who are now getting tired of showing off how much wealth they have.

And why do the wealthiest people like Kings and Emirs feel the need to get their offshore acquisitions financed through loans from London and Scotland? Do they not have enough money in their bank accounts to just walk up to a house, and handover a blank cheque to the owner? Are Banks set up in London or Scotland not regulated by any law? Has the British Government remained so complacent that they have not been able to detect global money laundering under their own noses by their own banks?

Is Saudi Arabia and UAE also involved in tax evasion and money laundering? Who’s taxpayer money have they invested in offshore companies? Are they even accountable for what they do with their own money? Why not? Is anyone, other than public representatives and servants, who are elected and selected respectively, accountable to anyone for what they do with their own wealth? Am I accountable to the nation for how I spend my wealth or where I choose to keep it? Do I have the right to decide for myself where I want to invest my money? Are there any barriers that stop me from investing anywhere in the world? Do I have the right to visit any place in the world, given I get permission from the state I wish to visit? Do I have the right to choose where I want to live, given I satisfy all conditions of the society? Do I have the right to choose where I want to study? Do I have the right to choose where I want to earn?

Even Palestine?

“Mohammad Mustafa, chairman of the Palestine Investment Fund, has been a close confidant to Palestinian Authority President Mahmoud Abbas since Hamas took over the Gaza strip in 2007. A former senior official of the World Bank, Mustafa joined the Palestinian government in 2013 when he became deputy prime minister for economic affairs. A year later, he held two titles – deputy prime minister and minister of national economy – until he resigned in March 2015. At the time of his resignation, Mustafa was in charge of reconstruction of Gaza after a 50-day war in the summer of 2014. Foreign Policy magazine called him “the most important man in the Palestinian economy.””

Inside the Mossack Fonseca data – Offshore investment company sent funds from Arab countries to Palestine.

“Mustafa has been a director of the Arab Palestinian Investment (Holding) Company Ltd. (APIC Holding) since March 2006. Founded in the British Virgin Islands in 1994, APIC Holding is the parent corporation of the similarly named Arab Palestinian Investment Company (APIC), which Saudi and Palestinian businessmen created the same year to channel “funds and investments from the Arab World to Palestine.” A year before he joined APIC Holding, Mustafa became CEO of the Palestine Investment Fund, one of APIC Holding’s numerous shareholders. In July 2013, the directors of APIC Holding changed its legal status to a public limited company and in March 2014, APIC started trading on the Palestine Exchange.”

Response

“Mustafa confirmed that since 2006 he has been a member of the board of the publicly traded Arab Palestinian Investment Co., where he represents the shares of the Palestine Investment Fund. He resigned as a director when he joined the Palestinian government, which he left in 2015. Then he rejoined in February, 2016. He noted that all his mandates “are cleared with all competent authorities in accordance to the applicable laws in Palestine.””

So offshore companies are also used to send aid to other countries, like Saudi Arabia sends to Palestine through the Arab Palestinian Investment Company. This funding network must be bothering someone.

How Is Pakistan Implicated In All This?

According to the ICIJ, about 200 individuals of Pakistani origin held offshore companies at one time or the other. Some influential names also showed up, but not important enough for any of the reporting agencies to write a report about. The website with the publications have flashy stories with caricatures of major power players and how they used offshore havens to stash “dirty money”, including Putin and Assad. Fortunately, none of these stories involve the state of Pakistan.

Above is a snapshot of countries implicated in global scams. If you are from Pakistan, you will notice that Pakistan is neither highlighted nor in the list of 12 countries mentioned. Then what is all the fuss about? Some prominent names from Pakistan’s political arena popped up, including that of current senators and judges. From the international business community, the names of the children of the Prime Minister of Pakistan also appeared, which has given the opposition ranks a glimmer of hope to influence public opinion against the Sharifs.

“Controversy has long engulfed Pakistan Prime Minister Nawaz Sharif’s family, including three of his four children – Mariam, Hasan and Hussain – over their riches from a network of businesses that include steel, sugar and paper mills and extensive international property holdings. At various times, depending on the political party in power, the Sharifs – one of Pakistan’s richest families – have been accused of corruption, ownership of illegal assets, tax avoidance and money laundering. Mariam, Hussain and their father have been detained on such charges, exiled to Saudi Arabia and also acquitted. When allegations first surfaced in 2000, a family member called them “completely wrong,” and declared: “This is a very religious family.” Hasan, who moved to London over 16 years ago, and Hussain have been running family businesses from abroad. Mariam reportedly is being groomed to take over leadership of her father’s political party.”

Inside the Mossack Fonseca data – Offshore companies owned United Kingdom properties.

“Three children of former and current Pakistan’s Prime Minister Nawaz Sharif – Mariam, Hasan and Hussain– were owners or had the right to authorize transactions for several companies. Daughter Mariam Safdar was the owner of British Virgin Islands-based firms Nielsen Enterprises Limited and Nescoll Limited, incorporated in 1994 and 1993. Sharif’s first term as prime minister ended in 1993. The companies owned “a UK property each for use by the family” of the companies’ owners. Hussain and Mariam signed a document dated June 2007 that was part of a series of transactions in which Deutsche Bank Geneva lent up to $13.8 million to Nescoll, Nielsen and another company, with their London properties as collateral. In July 2014, the two companies were transferred to another agent. Mossack Fonseca knew that Mariam Safdar was Nawaz Sharif’s daughter, a “Politically Exposed Person,” and committed to checking her activities twice a year beginning in July 2012. Hasan Nawaz Sharif was the sole director of Hangon Property Holdings Limited incorporated in the British Virgin Islands in February 2007, which acquired Liberia-based firm Cascon Holdings Establishment Limited for about $11.2 million in August 2007. Mossack Fonseca resigned as agent for Hangon because Hasan Nawaz Sharif was a ‘Politically Exposed Person’.”

Although the report clearly mentions that the members of the Sharif family were acquitted of all charges against them, the Pakistani tale still has some journalistic spice added in its analysis, comparing dates of incorporation of companies with PM Nawaz Sharif’s previous tenure ending in 1993. (Mentioning facts where they are not needed) It is interesting to note though that the offshore companies were registered when Nawaz Sharif was not in power. But he had apparently registered an offshore company while there is a political rift over corruption charges, and court cases being fought between Nawaz Sharif and the President and rival political parties, new elections being called and in the middle of all this, Nawaz Sharif planned to open offshore companies in the name of his daughter to purchase UK properties worth a few crores using looted wealth of the nation? It just does not add up. One has to remember that the Sharif family business was pumping billions into the tax net in the 80s. A few crore investments here and there are simply no big deal. Nawaz Sharif must have been super confident that he had done nothing wrong, all money was legitimate and no taxes (of that period) were evaded.

Either that, or the fact that Nawaz Sharif was not involved in any business related matters of the family. Since Nawaz Sharif’s name does not appear anywhere as a beneficiary or a trustee in any of the offshore holdings, there is no reason to believe that Nawaz Sharif had any control over any asset or transactions made by these offshore companies. His father, Mian Sharif, the respected business tycoon who had established his empire (twice) since 1939, was well alive throughout the 1990s, endured exile twice with his family and finally passed away in 2000. Perhaps, he was the man behind all the business purchases and offshore investments for his grandchildren from his share of inherited wealth? After all, he was the owner of Sharif/Ittefaq Group along with his six brothers. His son, Nawaz Sharif would certainly have been intentionally been taken out of the business structure, considering his role as the Prime Minister of Pakistan.

The Ittefaq Group had also split in the early 90’s after Nawaz Sharif was appointed as the Prime Minister of Pakistan for the first time, and transactions involving UK properties could be related to family settlement of Ittefaq Group assets which were being dwindled between 119 offsprings, siblings and spouses of the seven brothers who owned the business empire. In 1996, a final agreement was reached in the Lahore High Court for the settlement of assets amongst the family. If their assets were acquired illegally, it would take some courage to present the family assets voluntarily in front of the Lahore High Court in order to declare and divide equitably.

Nevertheless, the incorporation date of an offshore company does not prove anything. Many a times, law firms use already registered companies and change ownership to save process and time, so incorporation date is immaterial in this case. It may have possibly been registered before and brought under ownership of the Sharif family at a later date. The company’s registration date remains the same for legal purposes.

Moreover, while Mossack Fonseca is still represented in data as an ‘active’ agent, the ICIJ report claims that Mossack Fonseca resigned as agent for Hangon Holdings. There is no documentary evidence provided to prove this last statement than the claim made by the journalists. A few more contradictions are present. Why did Mossack Fonseca commit to check Mariam Safdar’s activities twice a year, knowing she was a PEP, residing in Pakistan with her politically affiliated father, until the companies were voluntarily struck off in 2015? Whereas Mossack Fonseca apparently refused to remain agent of Hasan Sharif, who has been living abroad and practicing business abroad with no affiliation with Pakistan or its politics, just because he was a PEP? Was it because he used his full name (Hasan Nawaz Sharif) to carry out transactions?

In a document shared by ICIJ through their website, Hasan Sharif signs three times on a money transfer request. Two are required, while the third is for a hand-written addition in the electronically generated slip. The hand-written addition was made by Hasan to add Nawaz as a middle name, so that there is no confusion in identifying the beneficiary of the said amount. Why would a person “hiding his wealth” in offshore companies insist on writing his full name in the papers that could “expose him” without doubt? The money simply must not be dirty.

Moreover, the journalists must have a very good source, as they seem to know that Mariam Safdar is being groomed to take over leadership of her father’s political party. Is that in there just to create rift amongst the senior ranks of the party? Recent propaganda has been aimed towards similar objectives; with some proposing Ch. Nisar, while others pushing for Shahbaz Sharif to take over the reins. Fortunately, none of the proposing or pushing is coming from within the party, which is united under its leader Nawaz Sharif: the N, in the PML-N.

Imran Khan’s Allegations

‘Panama Papers’ somehow proves allegations that Imran Khan has been leveling on the Sharif Family, ever since he has reignited as a self-proclaimed national leader. Imran Khan has been asking Prime Minister Nawaz Sharif to declare his assets and resign for rigging the General Elections of 2013 in which he believed his party was achieving a landslide victory, despite fielding the exact amount of candidates needed to form majority government and ignoring the remainder of the population. It would have been one of the greatest improvements in national assembly position by a single party, increasing its tally from 1 seat in the 2003 elections, zero in 2008 to 160+ by 2013. Mr. Khan was quite optimistic, if not delusional.

Prime Minister Nawaz Sharif has declared all his assets as well as tax details which have also been publicized by the media, yet some leaders turn a blind eye towards it. Or maybe trying to make use of how unaware generally people are, and cultural dependence on hearsay to get along. If he had not declared his assets, how would a common person like me know that Nawaz Sharif has assets worth Rs. 1.75 Billion, whereas Imran Khan has assets worth Rs. 33.3 Million, including his 300 kanal house in Islamabad? A person living in Islamabad would be wondering how a person owning a 300 kanal house in Islamabad under his own name is worth only Rs. 33.3 Million.

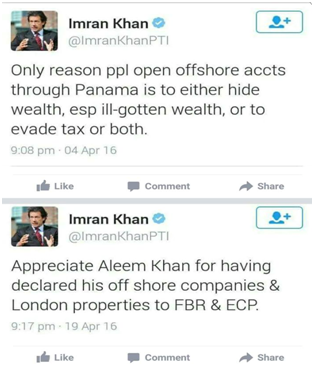

A closer look at both leaders’ declaration of assets reveals the answer. While Prime Minister Nawaz Sharif’s asset details are quite extensive, declaring cost and current market value of all of his assets (including gifts and inheritance), most of Imran Khan’s properties have no value attached to them and are just labeled as “gifted” or “inherited”. There are no mentions of how much the property costs and how much its current market value is. So while Nawaz Sharif’s declaration gives an accurate figure for Nawaz Sharif’s wealth, Imran Khan’s wealth figure is highly underestimated, and does not reflect a true picture of his assets. Election Commission of Pakistan (ECP)? Anyone? Does anyone even know his source of income? Or are the people around him really his ATM? One of his ATMs have been caught up in this Panama scandal as well, but Imran Khan had no clue about it until recently. “Mera kutta kutta, tumhara kutta Tommy?” This statement could not be explained better by the following set of tweets.

And why is Imran Khan complaining about Nawaz Sharif’s children and their activities? Where are Imran Khan’s children? Are they not overseas as well? If his children can stay overseas and invest overseas, why cannot Nawaz Sharif’s children? Is the law equal for all? If a common Pakistani investing overseas is not accountable to anyone for his investment decisions, then why are the children of Nawaz Sharif accountable for their actions that are not even remotely affiliated with Pakistan or its territory? Shouldn’t the law be the same for everyone? Imran Khan, himself, has stated many a times that a society goes towards degradation when influential people are governed by different laws than a commoner. Ironically, he, himself is suggesting a different set of laws for influential people compared to the commoner. His stand would be vindicated if he had aimed his protest towards the general practice of tax avoidance by all 200 Pakistanis mentioned in the leaks as well as the 200 Million population that is forced to bear higher indirect taxes because of the general culture of tax avoidance. But that is not expected of a man who burnt his utility bills on national television and called for a nation-wide civil disobedience movement which was aimed at evading taxes rather than avoiding taxes, going to the extent of advising how to do it through fraudulent channels such as ‘hundi’.

The Prime Minister has declared about Rs. 1.75 billion in assets. Imran Khan believes he has more, which he is hiding, under the names of his children, in offshore companies. Imran Khan believes that Nawaz Sharif is so evil that he uses his children’s names for his dirty evasive money laundering, so that if the authorities find out, he will be safe, and instead his children will go to jail. Is the Prime Minister really that evil or stupid that he will implicate his children as abettors in a tax evasion and global money laundering scam?

The Prime Minister’s stance is different. He believes that his children are old and mature enough to live privately and manage their businesses which they set up themselves using inheritance wealth or whatever other means they can, such as loans. Due to their experience in Pakistan, Hussain and Hasan Sharif chose to do business in Saudi Arabia and the UK. Moreover, they work abroad to avoid conflict of interest, or else they would be implicated in Pakistan for using ‘influence’ in ‘approving a loan’ from the bank. Any business they would have done, if successful, would be torn apart by the opposition through allegations of corruption.

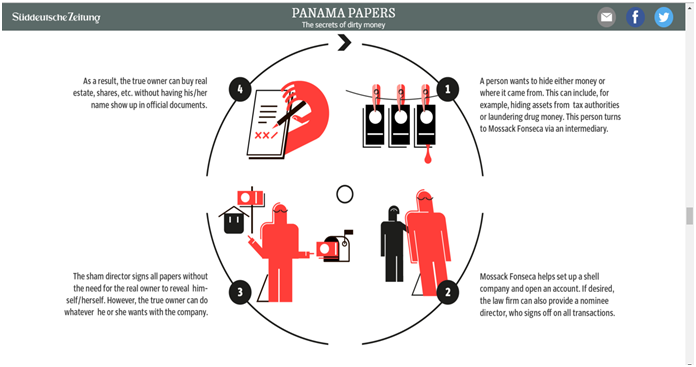

To establish business in the UK, the brothers used offshore companies to hold and gather loans from their UK properties. There is not a single link to Pakistan. So why are some Pakistanis concerned about tax evasion or avoidance or whatever Hasan and Hussain did in their time in Saudi Arabia, and the UK, under their laws and system, which are definitely working better than ours are. Offshore companies can also be setup using sham directors for an extra fee. If anyone wanted to hide their assets or their activities, they would certainly pay that extra fee. People doing illegal activities do not hide behind their own names, they use other names, and especially not their children’s names. The following is the process to open an offshore company with a sham director:

The Prime Minister has been given the green signal from all courts present in the country to govern the country as a Prime Minister who cannot be disqualified on matters he has already dealt with successfully in the past in these very courts, where judgments are present which acquit the Prime Minister from all charges against him. Ironically, Imran Khan, the Chairman of a party which calls itself Justice Movement, refuses to believe those judgments and claims that the Prime Minister is rich enough to buy the judges and use his influence to get favorable judgments. Imran Khan’s attitude towards judges has scared judges to the point that they try to avoid any confrontation with the man. He has already maligned two former Chief Justices of Pakistan including three former Judges of the Supreme Court, during his 126 day sit-in, as well as made life misery for the sitting judges of the Supreme Court, during that very period. The Judicial Commission under the Chief Justice of Pakistan which gave verdict in favor of PML-N and Mian Nawaz Sharif, in the 2013 Elections Rigging Case, also came under fire of Imran Khan, who was disappointed in the decision and claimed that justice had not prevailed. Yet again, when the government decided to form a Judicial Commission to probe the Panama Leaks, and have a retired Supreme Court judge as the head, three retired judges who were approached have requested to distance themselves from the case, to save their own reputations from the spontaneous Imran Khan.

So Imran Khan, basically says that all institutions, including the Federal Government, Supreme Court, NAB, ECP, FIA, FBR, Media, are corrupt and evil while he is the only truthful person in the entire political spectrum who deserves to be the Prime Minister, but unfortunately all institutions are conspiring against him. He believes earthquakes and natural disasters are special messages from God which only he can decipher. It’s a sign from God when it rains, it’s a sign from God when it quakes. Indeed, these are all signs, amongst the other billions of signs we can see every day, in our day to day life. There are signs for those who ponder/think. So if Imran Khan only gets signs when it rains or quakes, he is not really thinking that much is he? He may be letting someone else do the thinking.

The Prime Minister’s Version

The Honorable Prime Minister of Pakistan, Mian Nawaz Sharif is one of three sons of Mian Mohammad Sharif (1919-2000). Mian Mohammad Sharif was a wealthy businessman and industrialist who had established the Ittefaq Foundry, a relatively modest cast-iron parts business, along with his six brothers in 1939. After Independence, the Sharif family, migrated to Pakistan and settled in Lahore where the family started the iron business, initially on a limited scale.

During the initial few decades, the Pakistan government aggressively pursued an import-substitution policy and protected its domestic firms from foreign competition. Within a decade, the Sharif family rose to prominence as they expanded out to different industries from steel to sugar. After setting up the Ittefaq Group of Companies, Mian Sharif entered the social fray with several welfare projects; Sharif Medical City in Raiwind being his last welfare project in Pakistan.

Their business operations were interrupted when Zulfiqar Ali Bhutto’s government nationalized Ittefaq Foundry in 1972, stripping them of most of their key operations. Their businesses became national assets and started accumulating the debt that all subsidized government ventures do. In return, the Sharif family got peanuts for compensation. Mian Sharif founded the Sharif Group of Industries in 1974 after the nationalization of the Ittefaq Foundry, and consequently moved his business to the UAE, as doing business under the PPP regime seemed futile.

Mian Mohammad Sharif was a respected man. He had established an empire before, so he could do it again. You can strip a man’s wealth, but unless you drive him crazy, you cannot strip him of his mind. As Hussain Sharif said on air, that the fact that their family has business acumen is completely being discounted in all debates. And that is true. Everybody has a short memory, and seems to forget that the Sharif Family were a respectable religious family known for their 76 year business experience and their close ties with Saudi Arabia.

Mian Sharif and his three sons returned to Pakistan after General Zia-ul-Haq took over the reins of the system. General Zia denationalized assets that were stripped by Zulfiqar Ali Bhutto and returned them to their rightful owners. The companies had accumulated millions in debt under government possession, which the Sharif family later paid off from their own revenues. It is pertinent to note that two other nationalised units, Nowshera Engineering in the NWFP and Hilal Ghee in Multan, were returned to their rightful owners.

In 1983, General Ziaul Haq inducted Nawaz Sharif into the Punjab provincial cabinet as finance minister. At that time the Ittefaq Foundry’s turnover was in the billions, and it was paying revenues to the government. During the decade of the 80’s, the industrial sector picked up pace, and Pakistan’s GDP grew substantially; averaging one of the highest in the world, much higher than neighboring India.

After the death of General Zia-ul-Haq in a plane crash in 1988, Benazir Bhutto, won elections in two provinces (Sindh and NWFP) and took oath on Dec. 2, 1988 as the Prime Minister. Mian Mohammad Nawaz Sharif formed the IJI government in Pakistan’s most populous province, and a coalition government in Balochistan. Benazir’s government soon came into clash with the Nawaz government in the Punjab. The government tried to force the Ittefaq Foundry – owned by Sharif Group – out of business by refusing, through the Pakistan Railways, to transport cart scrap, imported from the US, from Karachi to Lahore. Sharif group’s Ittefaq Foundry laid off 3,500 workers in the summer of 1989. In monetary terms, Nawaz Sharif still recalls the loss to the tune of Rs. 500 Million back then.

Benazir Bhutto’s government was dismissed by the President on corruption charges in 1990. Nawaz Sharif came into power for the first-time in 1990, but the President dismissed the government again in 1993 on similar charges. However, Nawaz Sharif successfully challenged the decision of the President in court, defending himself from corruption charges. But General Kakar had seen enough and forced both men to step down and called for new elections.

In the same year, Benazir Bhutto’s government returned to power for the third time, and Nawaz Sharif became leader of the opposition. Benazir Bhutto started facing problems with her younger brother Murtaza Bhutto, who had joined hands with Nawaz Sharif and started an anti-corruption movement across Pakistan, blaming the PPP’s policies and corruption for the slowdown in the economy. Not enough to prove, but the historical economic data supports his claims. Nawaz Sharif and Murtaza Bhutto began a “Train March”, from Karachi to Peshawar and the anti-corruption movement gained full swing. Following the controversial death of Murtaza Bhutto, President Leghari dismissed Benazir’s government citing Murtaza’s death and corruption as the reason.

Around the same time, the House of Ittefaq had split and according to an agreement reached in Lahore High Court by members of the family sometime in 1996, Ittefaq’s assets got divided amongst the family (including offspring and spouses) of the seven brothers.

Nawaz Sharif returned to power in 1997, with a thumping two-third majority vote. Nawaz Sharif emerged as the most powerful elected Prime Minister in the country, since its independence in 1947. His government was once again dismissed prematurely in 1999 through a military coup staged by the ex-COAS Pervez Musharraf after he was removed from office post-Kargil. The entire Sharif family was held hostage, their local assets seized, and eventually when the Saudi Government intervened, were sent into exile to Saudi Arabia.

Prime Minister Nawaz Sharif has three children. Hasan Sharif, Hussain Sharif, and Mariam Safdar. While Mariam Safdar, married to Captain Safdar, resides in Pakistan, his remaining two children are settled overseas where they have set up shop. Under General Pervez Musharraf’s rule, Hasan and Hussain were kept locked up in unknown places and at times Hussain recalls that his 2 year old son had to witness their torture. The psychological impact on the 2 year old along with Hasan and Hussain who were charged with no crime, is enough for one to choose to migrate and live elsewhere where they can practice freely. While Hasan still resides in Saudi Arabia, Hussain sold steel mills in Saudi Arabia and decided to move business to the UK.

A trend can be seen so far. Basically, you can break down an ant’s home. But it will just rebuild it. Elsewhere. To be safe. And that is what the Sharif Family did again when it was forcefully sent into exile to Saudi Arabia, in 1999 through a military coup. They had faced a similar fate in 1972 when they moved to UAE and started business. They had done it before, they could do it again.

After his family was sent into exile by General Pervez Musharraf, Mian Sharif established the Azizia Steel Mills in Saudi Arabia, through loans acquired from Saudi banks with the help of close aides. If Einstein ran away from Austria and came to your country, would you not give him resources to do his experiments? Why is Dr. Qadeer not allowed to visit any country such as Iran or North Korea or even Africa? There is something in his head which is very expensive. That was not at all a comparison of intellect between the Sharifs and the Doctors. But one has to understand that an asset is an asset. And if you happen to be one of the biggest steel magnates of the country, it is not that tough to get a loan expedited to start business.

In the years that followed, the Sharif family’s business flourished and soon they were able to repay all of their loans. Were they committing corruption in Saudi Arabia too? Where the penalty is death? Or did they really have the business acumen and luck to establish successful businesses. Particularly, in the steel industry. A family working in the steel industry since the 30’s must have some business knowledge which they have successfully replicated multiple times. Moreover, it is a widely known reality that the Sharif family follows all rules and regulations in doing any business.

And some people still have the nerve to ask where they got the money from? How can you ask a steel business magnate family in business since the 30’s about where they get their money from? Is it really that hard to earn money from a business? Whoever asks these questions, themselves do not know how to make money. This is what a daily wage mentality is: people who work for today, just to get by the day, with no long-term orientation leaving them quite short-sighted.

If Donald Trump claims to have made billions of dollars from a “small” million dollar loan that he got from his Father, nobody makes a fuss about that except for the fact that he called a million dollars small. Well, a million dollars is a small amount for a billionaire. But since he converted a mere million into billions, why cannot anyone else? That man, still gets to run for President of the most powerful nation of the world. And apparently, he has never avoided any taxes. Wow. Right.

Even Nawaz Sharif’s greatest foes could not prove a single corruption case against him. In the 9 years that followed his exile, despite an all-out effort by Pervez Musharraf – which included the creation of a separate independent institution, National Accountability Bureau (NAB), to probe all such matters – none of the cases registered against the Sharif family could be proven and all courts gave verdicts in favor of the ex-PM. Nawaz Sharif and Benazir Bhutto (who had also never raised the corruption finger on Nawaz Sharif, and was also sent into exile by the military dictator), signed the Charter of Democracy in the Mayfair Residence of the Sharif family, an event highly publicized in Pakistan. They eventually returned to the country in 2007.

Nawaz Sharif survived an assassination attempt in the morning of 27 December 2007, but Benazir was not as lucky. In one swift move, someone had planned to remove the two most influential leaders of the country, less than two weeks before elections, when they had come together as one to bring down the dictatorship of Musharraf. The death of Benazir Bhutto sparked nationwide protests and when the elections finally took place later that year, PPP came into power and waved goodbye to President Pervez Musharraf. While the two major parties (PMLN and PPP) remained friendly in the initial years, and restored the heavily manipulated constitution to its original form through the 18th and 19th amendment, real opposition was shown by the PML-N in the Long March of 2009, on the issue of restoration of judges that were previously sacked by Musharraf when he imposed emergency rule in November 2007. However, politics took a dirty turn with the emergence of a mushroom party, PTI.

While the firms of Sharif group in several industries still do exist, their continuous rape by successive governments and dictatorships have cooled down the chimneys of their operations in Pakistan. One of the largest corporations of Pakistan belonging to one of the wealthiest families, had been crippled. And so were the jobs of the tens of thousands of employees that the corporation had. In the name of “public interest”.

Some people also question how the Prime Minister can attract overseas investment for critical projects when the world “knows” that his children are investing millions overseas. Sadly, it is only Pakistani politicians and media that are constantly repeating false allegations of the actions of the First Family, and letting the world “know”. One thing Pakistan should know by now is that the only people who care about Pakistanis are Pakistanis, and maybe Turkish and Chinese too. Would anyone allow Hussain Sharif to invest in Pakistan while his father runs the government? What would be the opposition’s reaction if Hussain Sharif were to be awarded a contract by the government to set up a coal-fired power plant? Or a lucrative LNG deal? The opposition would cry wolf if that happened. So where should Hussain Sharif invest? If he invests overseas, that is apparently a problem. If he were to invest in Pakistan, that would certainly be a problem as well. And the world really could not care less about where Hasan and Hussain Sharif are investing. The world is smart enough to know why they are not investing in Pakistan, at a time when their father is the Head of State.

Amidst all this, Panama Papers only mentions a $13.8 million mortgage against properties held in the UK. Just to get an idea of average property prices in the UK, let us look at average selling prices of Mayfair properties from 1995 – 2016:

| 1995 | £245,000 |

| 1996 | £272,000 |

| 1997 | £375,000 |

| 1998 | £298,000 |

| 1999 | £505,000 |

| 2000 | £679,000 |

| 2001 | £539,000 |

| 2002 | £497,000 |

| 2003 | £638,120 |

| 2004 | £569,000 |

| 2005 | £881,000 |

| 2006 | £728,638 |

| 2007 | £845,000 |

| 2008 | £862,000 |

| 2009 | £787,546 |

| 2010 | £1,114,674 |

| 2011 | £1,514,293 |

| 2012 | £1,675,318 |

| 2013 | £2,435,020 |

| 2014 | £2,007,979 |

| Dec 2015 | £1,919,731 |

| Jan 2016 | £3,034,735 |

Considering the British pound was worth only Rs. 46 back in 1995, a Mayfair property cost about PKR 1 crore. Currency depreciation and increase in real property prices pushed the average cost of a Mayfair property to PKR 5.3 crores for a Pakistani by the year 2000. This figure touched 9.6 and 40 Crores by 2005 and 2016 respectively. So while UK prices have increased by about ten-fold; in terms of Pakistani rupees, the nominal rupee figures which are currently thrown around by politicians and media has shown an increase of forty-fold, mainly due to the deteriorating currency.

If you invested in Mayfair in 2006, you would have quadrupled your money by now. 400% Profit in 10 years is not at all a bad investment! Especially on two properties. Which basically doubles your profit. I would say that if anyone did make such an investment, they did themselves good. That is how you quadruple your money in a short time period. And some people just cannot comprehend how people make money. For a local Pakistani, viewing investment in local currency, a 2006 Mayfair property investment sold in 2016 would have generated a return higher than 500%, considering the depreciation in currency.

So what will the financial investigation agencies be looking for? Out of the millions of overseas transactions worth billions of rupees made by Pakistanis in the 1990s, the hunt will be for a few 10 million rupee transactions to buy properties in London. Not only will that be a search for a needle in a haystack, but also very unilateral and biased. If accountability is to be across the board, the investigation agency will have to study each and every transaction (over a threshold), and check whether or not any tax was evaded. Moreover, tax laws of the last century would have to be put in front to check whether or not tax laws of that time were fully complied with.

What The World Had To Say

Major Superpowers such as China and Russia, rubbished the reports, and claimed it to be a western hatched conspiracy aimed at causing instability in the region. For Pakistan and the region, CPEC is indeed a game changer, and will truly enhance the speed at which China is heading towards global supremacy. It revives the once talked about Super Highway which connected the world through roads, a major chunk of which goes through Russia.

“There have also been several questions about the American presence in the leaks. While it was revealed that 200 U.S. passports were among the documents obtained by the investigative teams, investigative partner McClatchy reported that many of them were simply retirees purchasing property abroad. Besides, as the New York Times and other publications have pointed out, establishing shell companies in the U.S. is also a straightforward procedure.” – (Time Magazine)

“Simply retirees purchasing property abroad.” Purchasing property abroad is a simple, normal procedure through offshore holdings. Duhh. So why is it such a fuss when it is a Sharif family member who purchases property abroad? Is the law not equal for all? If simple retirees from the US can buy offshore property, why cannot a wealthy businessman in Pakistan? If Aleem Khan can have offshore holdings under his own name, half of them undeclared, and still be appreciated, then why is the Prime Minister being targeted and asked to resign when he has no offshore holding under his name and has declared all of his assets?

While the PM of Pakistan presented himself for accountability, and called for an inquiry through a Judicial Commission headed by a reputable retired judge of the Supreme Court of Pakistan, the government’s stance is similar to what major Superpowers of the world have taken against a hatched conspiracy. The decision not to engage the current judges of the Supreme Court stems out of this stance of the government as it believes it is a waste of time probing these Leaks, in light of allegations leveled by an opposition party, coupled with threats to bring Pakistan to a standstill once again, and send us three steps back. The public at large are gradually getting more receptive, and understand how political stability is the backbone of all economies. Why would a party claiming to be a nationalist party, threaten a recovering economy, through open-threats of tumbling a democratically elected government through sheer force of people he terms as “Tsunami Tigers”?

The opposition parties in Iceland were able to gather about 10-20% of its ENTIRE population of 350,000 people, after the Prime Minister refused to comment on a question raised by a journalist regarding the Panama Leaks, thus forcing the Prime Minister to step aside temporarily while his name is being cleared. Rumors of other Prime Ministers in other states resigning are also emanating along with pictures of protests that took place half a decade ago. There has not been a single resignation of a Prime Minister in any other country due to the Panama Leaks. That is a fact.

If Pakistan, a nuclear state with a population of about 180-200 Million, can do the same, then be my guest, and stop the wheels of democracy, and send us back a decade. However in order to do that, opposition parties will have to gather 20-40 million protesting Pakistanis in front of the Parliament. The opposition barely gathered 100,000 protesters in 2014 when it created much hype over the election results, which did not come out as expected by a certain wishful thinker.

What To Do

The decision of the PM to establish a Judicial Commission to inquire about the Panama Papers may temporarily take off the heat, but it is not a permanent solution. It may be a politically correct move, as nothing from the leaks are linked with any illegal activity or wrongdoing. The quick reaction by the PM is seen as a challenge to all to prove him wrong. As the Pakistani nation were well-aware of the riches of the PM, way before Imran Khan started ranting about them, the ruling party may come out stronger with a clean bill as it presented itself for accountability, in the absence of any protest. The chances of the PM to get out of this mess unscathed are high as well, considering he has successfully challenged and faced all corruption charges against him in the past and has been acquitted as well. Pervez Musharraf in his 9 year governance stint could not prove a single case against the Sharifs either, despite having access to all government machinery.

Tax Law Reform

A more practical solution would be tax law reforms. Since retroactive punishment is not permissible, income tax laws may be easily amended. Rather than trying to collect tax that may have been evaded by spending more of the taxpayers money for this purpose would be a waste of time and resources. The tax base needs to be widened and laws should be devised in a way to avoid any future evasion. You will never be able to retain a bucket of water, no matter how many scoops of water you add to it, if there are leakages in the bucket.

U.S Tax law states that any person living on foreign soil for more than 330 days is not a ‘U.S person for tax purposes’. He may be a U.S person. But not a U.S person for tax purposes. The definition of a ‘Pakistani Person for Tax Purposes’ needs to be altered slightly. Currently, any person who has spent more than 180 days outside of Pakistan, is not required, by law, to file income tax returns or declare assets in Pakistan. In other words, a person who has spent 184 days in Pakistan, is not required, by law, to pay income tax in Pakistan. Which means that a person who spends most of his time in Pakistan may be able to avoid taxes. This timeframe needs to be enhanced to at least 270 days.

Foreign Account Tax Compliance Act

Pakistan should legislate and introduce a Foreign Account Tax Compliance Act as introduced by the United States in 2010. This Act would allow Financial Crimes Agencies in Pakistan to gather information regarding offshore financial accounts of Pakistani citizens. This does not create any disincentive for investors, but is aimed solely at curtailing corrupt practices. Everyone has the right to invest anywhere in the world to optimize their portfolios, through whatever combination of assets they find feasible, given they abide by all laws and regulations of the states they invest in.

In the U.S, FATCA was enacted for the purpose of detecting non-US financial accounts of U.S domestic taxpayers coming under the definition of ‘U.S person for tax purposes’. It is not enacted to detect non-resident U.S citizens and enforce collections. FATCA focuses on reporting by US Taxpayers about certain foreign financial accounts and offshore assets, and by foreign financial institutions about financial accounts held by US taxpayers or foreign entities in which US Taxpayers hold a substantial ownership interest. The law is used to detect assets, rather than income. It does not include a provision imposing any tax.

The implementation of the law however requires international support and inter-governmental agreements to bind financial institutions to identify persons from all nationalities and inform their respective governments. The information is then shared between governments. Although implementation cost would be high all over the world, it may not surpass the level of global tax avoidance reported.

Offshore Voluntary Disclosure Program

The U.S initially introduced an offshore voluntary disclosure program in 2009, where IRS worked with taxpayers whose penalties may be reduced. Ever since, the IRS has offered the same program in 2011 and 2012, each time with a higher penalty rate than before. However, it offers clear benefits to encourage taxpayers to disclose foreign accounts rather than risk detection later and possible criminal prosecution.

What Not To Do

Do not blindly follow what the group of 5 (UK, France, Italy, Spain and Germany), IMF and OECD plan to do along with the US. They will frame laws that will govern the global financial system, on the pretext of saving the world from terrorists and their financiers. The oil price crash signaled another North-South conflict, which has escalated to the extent of imposing another world body or getting global support for another set of laws to govern the global economy. The South have to be very careful to protect their own interests, and to use this opportunity to reverse all the previous bad laws that have been used by the North to extract trillions of dollars from our national economies through multi-national companies and debt financing.

There is a huge debate that is to follow in the near future, and the terminology tax, and why people have to pay these taxes needs to be clearly defined in the upcoming debate. Tax should be indiscriminate and directly proportional to the time spent in any territory. If a person spends 50 days in Pakistan, he is liable to pay taxes on any income earned in those 50 days that he spent. If he spends a month in the US, he is liable to pay any taxes on any income that is earned in those 30 days. Though it would be a tough task keeping up with reporting requirements and also keeping track with movement of labor, it would not be a bad idea to set up a new field of work since we are facing the problem of unemployment as well. As long as cost do not exceed the benefits of tracking offshore accounts and possible tax evasion.

And Please. Please. Please. Do not think about invading the capital over this non-issue. The capital is not part of any province, and we have our territorial sovereignty. It is not a public park where you can hold a party anytime you wish. By protesting, public goods, such as roads, no longer remain public goods as they lose their characteristics of being non-rivalry and non-excludable. Rights of people living in the cities are hindered, and their daily lives are made miserable as they are forced to manage through unnecessary road blocks, traffic jams and diversions as well as heightened security measures to ensure their properties are safe.

While you have the right to travel freely across Pakistan, you also have the duty to ensure that your actions are socially acceptable. Islamabadians/Islooites, have had enough of protests. Your protests are not protests. It is pure blackmailing. And a loss to national output. You slow down the whole economy, literally, by blocking routes and creating uncertainty. The dharna season of 2014 destroyed the entire greenbelt of the constitution avenue and surrounding greenery and trees. Trees were actually burnt down by the same people who claim to have planted millions of trees in KPK with a success rate of over 90% determined within 6 months of plantation. Who are they exactly trying to fool? And now they want to invade the F-9 Park of Islamabad, the most active and beautiful park of the city where thousands, from all age groups, gather every day for recreation and fitness activities. To do what? Celebrate the founding day of their party. Islamabad will never allow that after what mess they left when they invaded the Red Zone. It would be more appropriate for the function to be held in Peshawar, the capital of the province they govern, or the hometown of the PTI Chairman in Mianwali. Please keep Islamabad out of this. Islamabad would prefer not to be affiliated with PTI. Sorry. Islamabad is a clean city, and authorities are trying to make it cleaner.

Before you think about your own rights, think about your duties. If you want the constitution to work for you (i.e. to ensure your fundamental rights), you have to work for the constitution (i.e. ensure your duty as citizens of the state), as stated in Article 4 (Loyalty to state) of the Constitution, which includes not threatening to destroy public transport systems or threaten the life and liberty of other citizens around you. If you are loyal to the state, you follow the rules. If you do not follow the rules, you are not loyal to the state. If you are not loyal to the state, you are not eligible for the fundamental rights you rant on about.

And please, do not go to the extent of maligning the dignity of individuals, based on allegations and rumor. Every individual has fundamental rights to their dignity, privacy, and livelihood. And no citizen of the state can be given the permission to take such matters in their own hands. There should be complete rule of law, and if any person is to be punished, it should be done by the state, through its organs, without prejudice, by following due process.

The views expressed in this article are those of the author and do not necessarily represent the views of CourtingTheLaw.com or any organization with which he might be associated.

Extensive piece of research and well informed. But the solution is quite long term, what I believe is that NAB should play an active part. At least Panama provides a begining